Intro

We’ve been describing companies’ online digital presence in various regions. Among industries that we’ve described in our previous research, you can find Retail, Banks, Telecom, and Airlines in such regions as the EU, US, India, and MENA. This time we would like to pay special attention to the Gulf Cooperation Council countries that include Bahrain, Kuwait , Oman, Qatar, Saudi Arabia, and United Arab Emirates. Among niches we would like to start with the banks, as this is one of the most important business niche for any country. In addition to that banks all around the globe heavily invest in digital innovation and GCC is no exception here.

However, before we proceed with our analysis let us explain why we decided to start with that region. GCC is a rapidly digitalizing market that is not surprising to anyone. And the rapid level of digitalization affects businesses and consumers likewise:

- GCC continues to grow. The World Bank’s research shows that in 2024 the region’s GDP (gross domestic product) growth is projected to strengthen to 3.6 percent, and in 2025 by 3.7 percent, fuelled by robust oil prices and vigorous non-oil activities.

- According to KPMG, customers in the GCC region are increasingly sophisticated and expect more from their brands, including personalized experience, greater value for their money, and seamless, omnichannel processes.

- Statista reports that the GCC region's efforts toward economic diversification and digital transformation are driving the growth of the digital banking sector. With governments in the region promoting innovation and technology adoption, digital banks are well-positioned to take advantage of these opportunities.

The banking sector in the GCC has seen consistent growth fueled by infrastructure developments, initiatives for economic diversification, and the demand for diverse banking services from a young, wealthy population. Customer behavior indicates that appropriate actions to meet this demand are expected:

- Insights from a Backbase Research survey, which polled 2,016 individuals in Saudi Arabia and the United Arab Emirates, clearly show that consumers desire their banks to go digital. One of the top three factors driving customers to switch banks was the prospect of an enhanced customer experience.

- GCC customers are active online. KPMG and Data EQ analyzed sentiment index of the GCC banks on X (formerly known as Twitter) and presented some interesting findings. Saudi Arabia dominated the conversation within the GCC’s banking sector with an overwhelming 83.3% of total online conversation, while the UAE led with the highest proportion of positive mentions, garnering praise that accounted for 21.1% of its conversation

According to EY, integrating primary customer research with transactional and behavioral data can yield actionable insights into customers' changing needs and expectations. To achieve true customer centricity, a customer-focused approach must be embedded and scaled across the entire organization. And this market is clearly understood by business as 87% of business leaders identified CX as their top growth engine.

However, which channels apart from social networks could be valuable sources for understanding customer sentiment? Where else are customers looking for brands and sharing their opinions? The answer is online maps and review services, and let me explain why. Where exactly are customers searching for services? Most probably they would start with a search engine. Search engines will show location-based results. From there customers could read reviews about banks on online maps and review services and create routes to go from online search to offline branch or visit a website.

However, what are the biggest search engines in the GCC? According to our research it’s Google, Bing, and Yandex. These search engines account for 99% of online traffic and companies can't afford to overlook them.

According to Statista, Google pretty much dominates the search engine in GCC. However, in TOP-3 also could be found Bing and Yandex.

Search engines will pull information from their online maps (e.g. Google from Google Maps, Yandex from Yango etc). Thus, it’s important to keep correct information about businesses not only on websites but also on online maps.

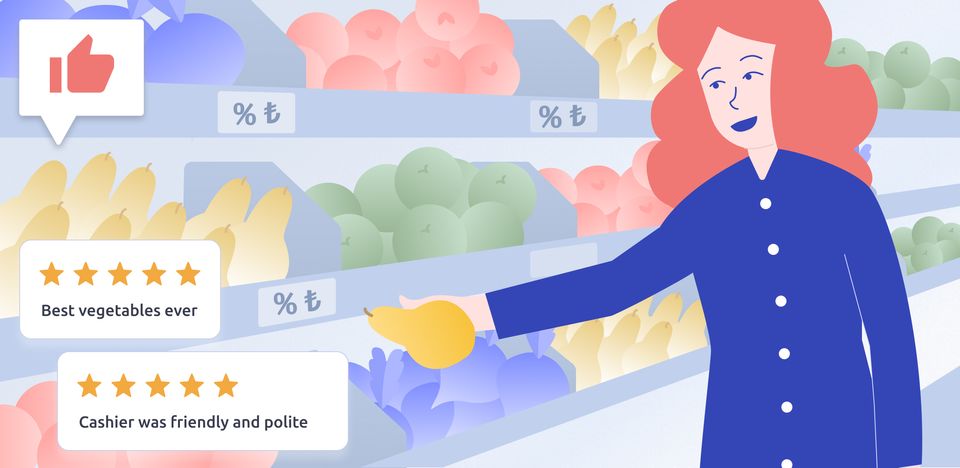

However, simply keeping information updated is not enough, as according to Zendesk banking customer experience research, 62% of customers say that personal reviews are more important than an overall description. In addition to that, prominence is still among the most important local SEO factors, as that’s how the customers could be assured that the business is trustworthy. Therefore, GCC multi-location companies should also focus on managing reviews, especially negative ones, as they can significantly harm their online reputation.

Nevertheless, with a proper strategy and right tools, multi-location businesses could turn even highly critical clients into loyal fans:

- According to McKinsey, improving customer experience can increase a customer’s loyalty to a bank by 72%.

- A study by Lee Resources found that 70% of customers who complained and received a satisfactory response from a business representative are likely to return and give business another chance.

Thus, implementing online maps and review services into an omnichannel customer experience strategy is an essential step for banks in order to react to a growing customer demand. With Google as a search engine that is responsible for 96% of online traffic in GCC, it’s necessary to pay attention to Google Maps first, but also don’t forget about Bing Maps and Yango Maps.

Which banks are going to be analyzed?

Our research analyzes online presence of 25 banks in 6 GCC countries by tracking an extensive dataset comprising 15 317 Google Maps locations, 348 416 reviews and 110 540 photos. We’ve decided to focus on the biggest GCC banks by the amount of assets, as these banks are leading digital innovation in the region. That allowed us to highlight regional trends and represent all countries of the GCC accordingly:

- Saudi Arabia - 7 banks in total. Among them such banks as SNB, Al Rajhi Bank, Riyad Bank, SAB, BSF, Alinma Bank, ANB

- UAE - 6 banks in total. Among them such banks as FAB, Emirates NDB, ADCB, Dubai Islamic Bank, Mashreq Bank, ADIB

- Qatar - 4 banks in total. Among them such banks as QNB, Qatar Islamic Bank, Commercial Bank of Qatar, and Masraf Al Rayan

- Kuwait - 3 banks in total. Among them such banks as KFH, NBK, Burgan Bank.

- Bahrain - 3 banks in total. Among them such banks as ABC, Ahli United Bank, Al Baraka Bank

- Oman - 2 banks in total. Among them such banks as National Bank of Oman (NBO), and Bank Muscat

The situation with Google Maps for MENA banks has opportunities for significant improvements as 22% of them are missing necessary information about their business on Google Maps. The count was determined by verifying data completeness for fields such as address, coordinates, telephone, category, photo, site, description, and attributes. Additionally, they are not managing reviews and have numerous unclaimed profiles. However, this is just a small part of the issue, so let's delve into our research further.

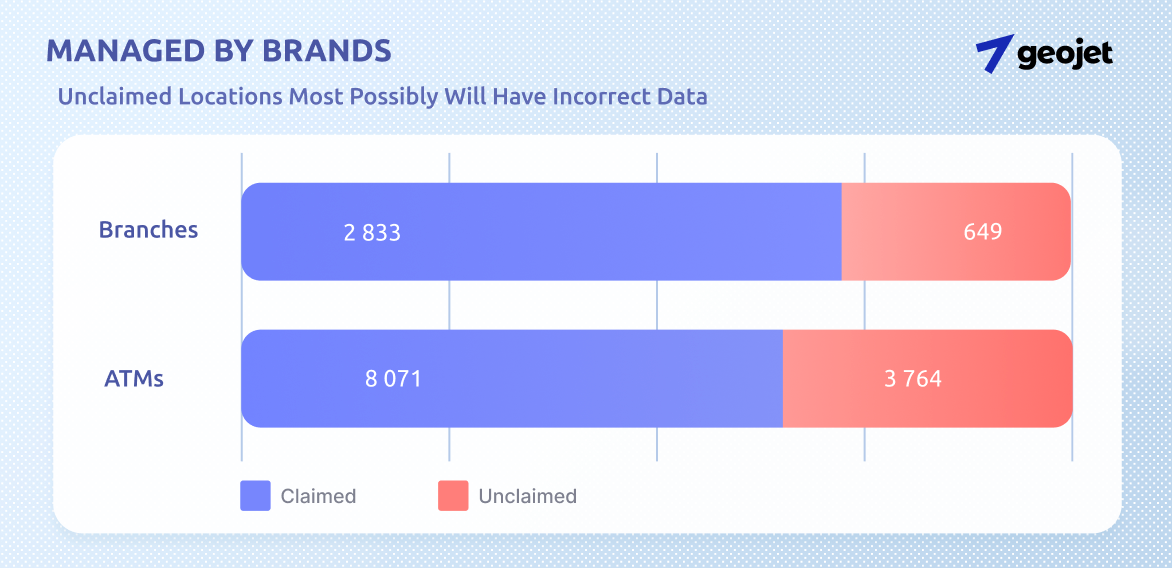

From a total of 15 317 Google Maps locations there were 3 482 branches and 11 835 ATMs. Of these locations, 4 413, or 28.8%, are not directly managed by the brand. Specifically, this includes 649 branches and 3 764 ATMs. This lack of direct management may lead to negative consequences, such as clients arriving to incorrect locations at incorrect times.

The average data completeness stands at 78%, with banks often lacking crucial information such as websites for 3,533 locations (23.1%) and telephone numbers for 2,983 locations (19.5%). This supports the earlier observation that many physical locations are not directly managed by the brand, leading to potential clients arriving at businesses during incorrect hours or at wrong addresses, causing dissatisfaction. Additionally, many locations are missing essential business attributes and descriptions.

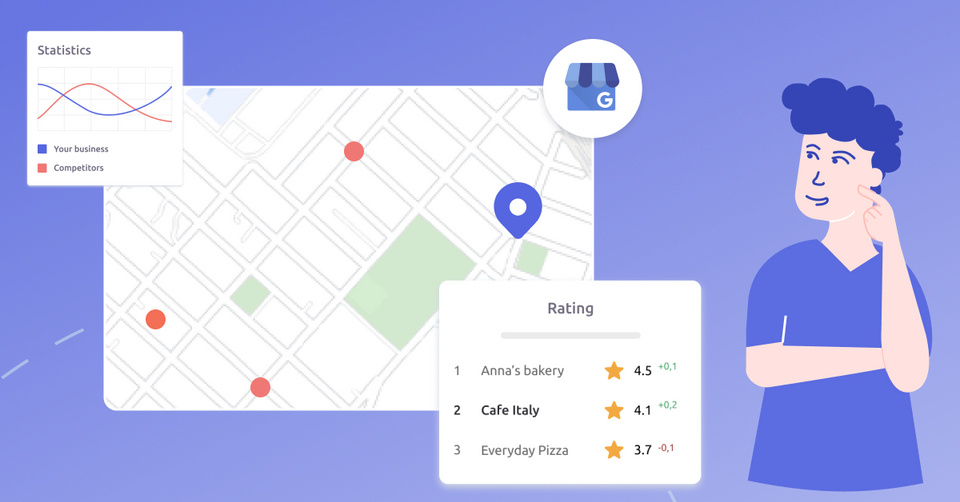

The average rating of the analyzed locations is 3.6, derived from 348,416 reviews. This falls short, as customers tend to perceive companies with an average rating of 4.0 or higher as more reliable. This issue is particularly pronounced for MENA banks’ brick-and-mortar locations, where 10 151 (66.3%) have ratings between 1.0 and 3.9. Additionally, 3 641 locations (23.8%) have no ratings at all, indicating a lack of customer engagement and potentially harming their online reputation.

For those working in local SEO, we recommend focusing on these locations first, as improvements here can yield immediate results and significantly enhance the companies' search engine presence. Even a small rating increase of 0.1 can boost conversions by 25%. For guidance on how to achieve this, we suggest reading one of our recommended articles.

For all above-mentioned locations we also found 110 540 photos that indicates a strong social engagement. However, many of these photos were irrelevant, and we strongly recommend that companies pay closer attention to this aspect. Notably, 10,713 locations (69.9%) have fewer than five photos. That results in lower customer engagement, as locations with updated and relevant photos and videos are viewed 15% more often. To enhance their online presence, companies should start by uploading relevant photos and filing complaints to remove irrelevant ones.

GCC Local Serach Trends for Banks

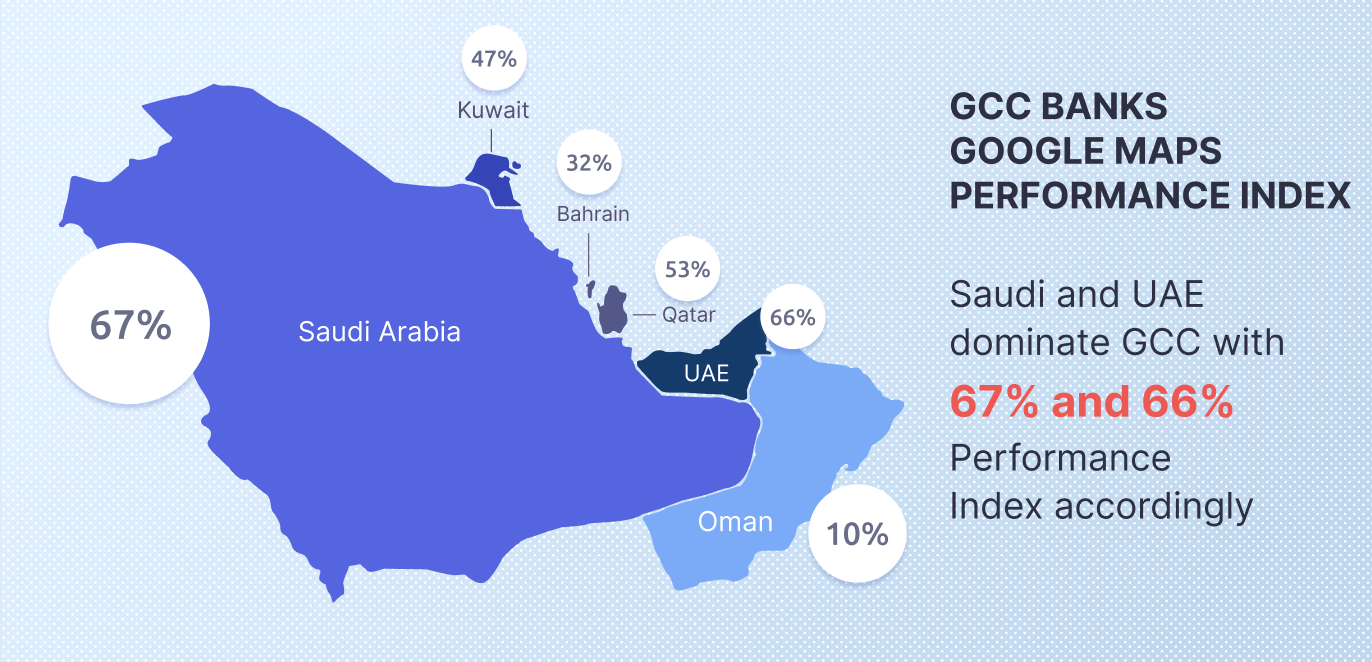

By extensively analyzing the above-mentioned statistic we were able to identify local search trends for each analyzed GCC country, such as Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates. All of these metrics were defined as Geojet Performance Index and could be seen on a map below.

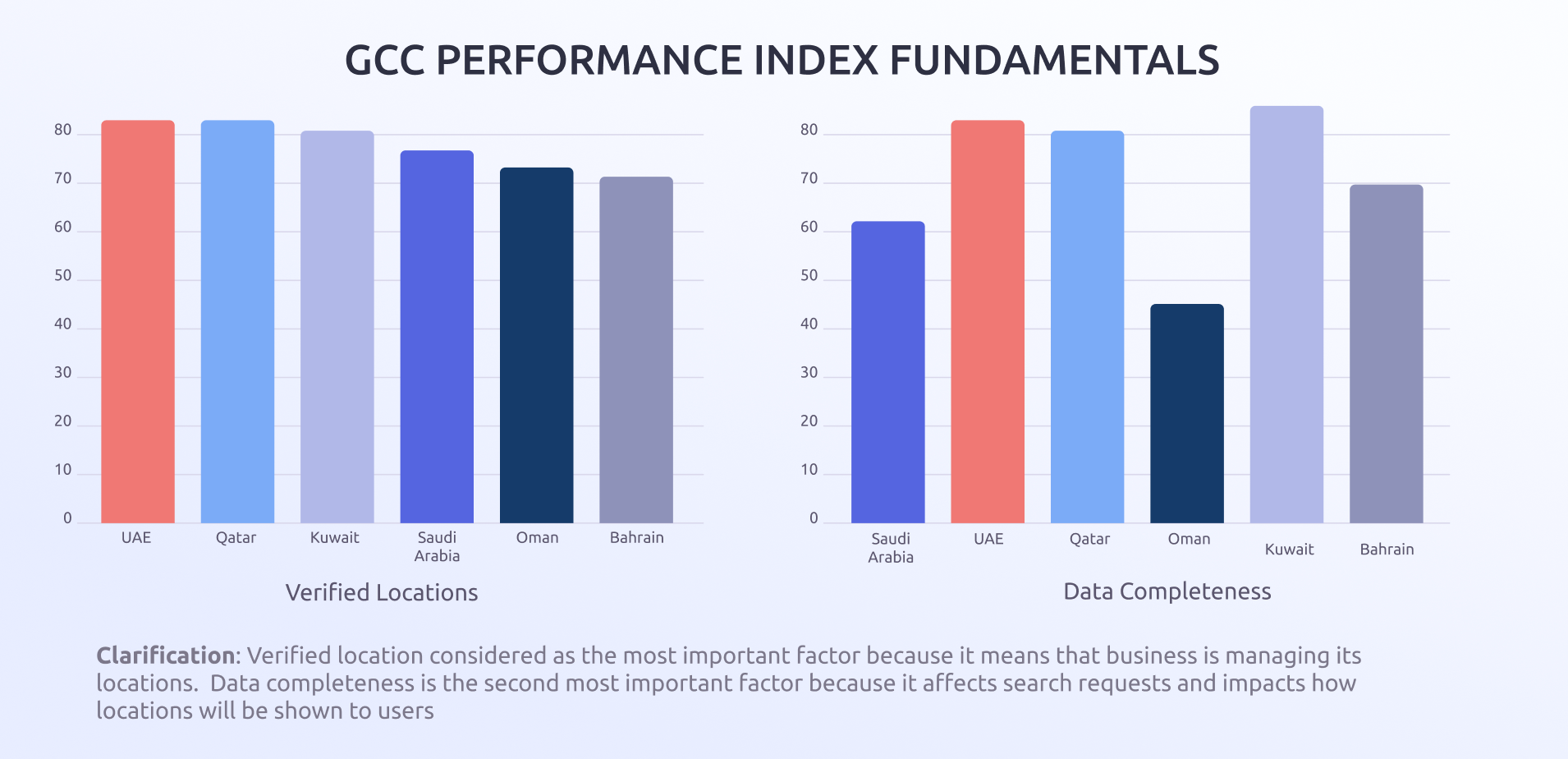

Thus, by working with first 5 metrics banks can significantly boost their Performance index. And let me explain in details why it’s important and how to boost them. Verified locations are critical for trust and credibility. Verification assures customers that the information is accurate and that the bank is legitimate. Given its significant impact on customer trust and decision-making, this metric was assigned the highest weight.

Complete information about each location is crucial for customers to make informed decisions. Incomplete profiles can lead to confusion and a lack of trust. Thus, ensuring data completeness was given a relatively high weight to emphasize its importance. Therefore, banks should start working with verification of their locations as well as upgrading data completeness, as these metrics ensure trustworthiness and comprehensive information.

However, such metrics as rating, reviews, and photos are also impactful for the business and here is why. Customer reviews are a direct reflection of their experiences and satisfaction levels. High ratings are essential for building a positive reputation and attracting new customers. These metrics were given a significant weight to highlight their role in influencing potential customers' perceptions.

The number of reviews can indicate the level of customer engagement and provide valuable feedback. However, it's the quality of reviews (reflected in the rating) that has a more substantial impact. Therefore, reviews were given a moderate weight, acknowledging their importance but not overemphasizing them. However, by working with reviews, or customers’ opinions in a broader sense, businesses could eventually improve their ratings by winning over customers who left negative reviews and convincing them to give a business a second chance.

Photos help customers visualize the bank's facilities and services, contributing to their decision-making process. While important, they are one part of the overall profile. Thus, photos were assigned a moderate weight to balance their visual appeal with other information metrics. However, businesses still should upload relevant photos in order to establish a proper customer experience.

The least impactful metrics are amount of locations on Google Maps and population. Talking about the amount of locations, of course bank should put all their brick-and-mortar locations on online maps. However, when this is achieved it will be more important to provide relevant information to all of these locations and work with reviews. Such metric as population, could not be influenced by a bank directly and here it is mostly to provide context and balance data analysis between countries with a huge population difference (such as Saudi Arabia and UAE). Thus, these metrics could be considered complementary ones.

From some other interesting factors we would like to highlight some interesting social engagement metrics: Qatar has the biggest amount of photos per million on Google Maps, while UAE has the biggest number of reviews per million. That clearly shows that people also would like to interact with bank in these channels more often.

Conclusion

Understand the GCC's banking sector online presence is a multifaceted task. This study captured certain problems by examining Google maps banks’ presence via various metrics. With the highlighted local trends from Performance Index, GCC banks have a roadmap on how to significantly improve their performance on Google Maps. 6 out of 7 metrics could be easily maintained from a Geojet dashboard.

Whilst, our analysis was mostly about Google Maps, GCC banks should also pay attention to Bing Maps and Yango Maps. A special attention should be addressed towards Yango Maps. Despite Yandex being only 3rd as a search engine, a company is heavily investing in that region with Yango Maps. That could be especially crucial for the UAE as, according to Yango Maps is among other Top Navigation Apps, such as Google, Apple Maps, and Waze, while driving in Dubai. We also did a research on Yango Maps improtance and you can check it out for more details.

When properly managed, online maps can be a powerful tool for attracting a growing consumer base and mitigating potential controversies. On the other hand, poorly managed work with online maps and review services can present significant challenges to a brand’s reputation. All of that leads us to the conclusion that GCC banks still have a significant opportunity to grow. We at Geojet have experience in providing the following results for banks:

- Increase the number of created routes from online maps by 44%. That brought more potential clients from online maps to offline branches.

- Increase discovery visits by 45%, meaning that ATMs and branches became discoverable not only via their names/addresses but also via their categories

- The number of site visits has increased by 24%

You can check our cases in more details here. If you would like to see the same results for your business let us know at [email protected] or contact us via a chat.